You’ve heard the stories: “I got started with just $800.” or “Oh, you need at least $10,000 to successfully start an e-commerce business.” While the stories may vary, they all share one truth: You need funding to achieve long-term success for your online business. How do you know where to start?

There are a variety of types of funding, each appropriate for different points along your e-commerce journey. While this list is a comprehensive view of the different types of funding, there are a variety of times and uses for each type. Remember: Nobody knows your business better than you and no two businesses are the same, so make the decisions that work best for your brand, based on the data you have on hand.

All Online Businesses Can Benefit from Funding

As a business grows, it’s only natural that it needs more cash flow. More sales results in the need for more inventory. More inventory means a larger warehouse or increased logistics setup. A larger warehouse means more staff. It’s an endless cycle that means only good things for your business.

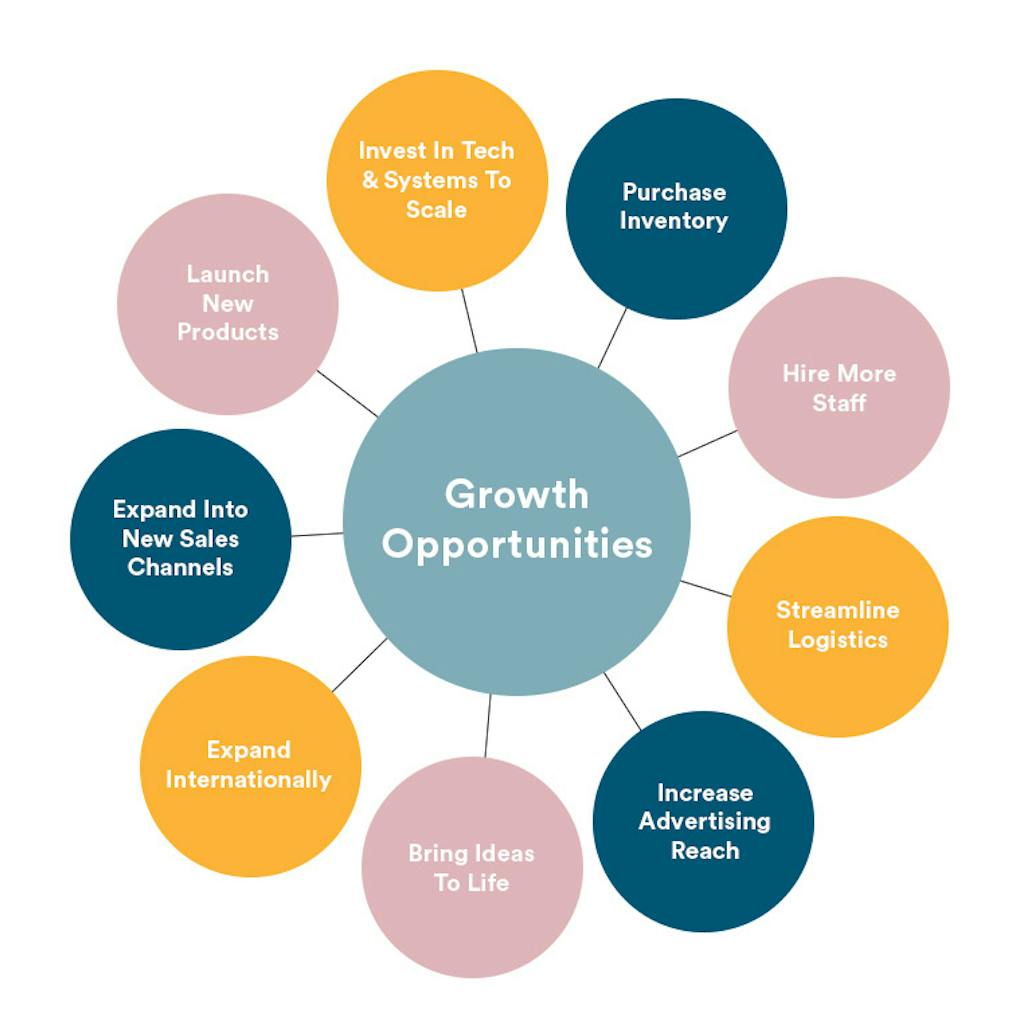

However, without funding at the right time, you could actually be harming your business’s growth. The worst thing would be to run out of inventory or lose your advertising placements because you ran out of budget. Just look at the opportunities that having sufficient cash flow can bring to your business.

Types of E-Commerce Funding

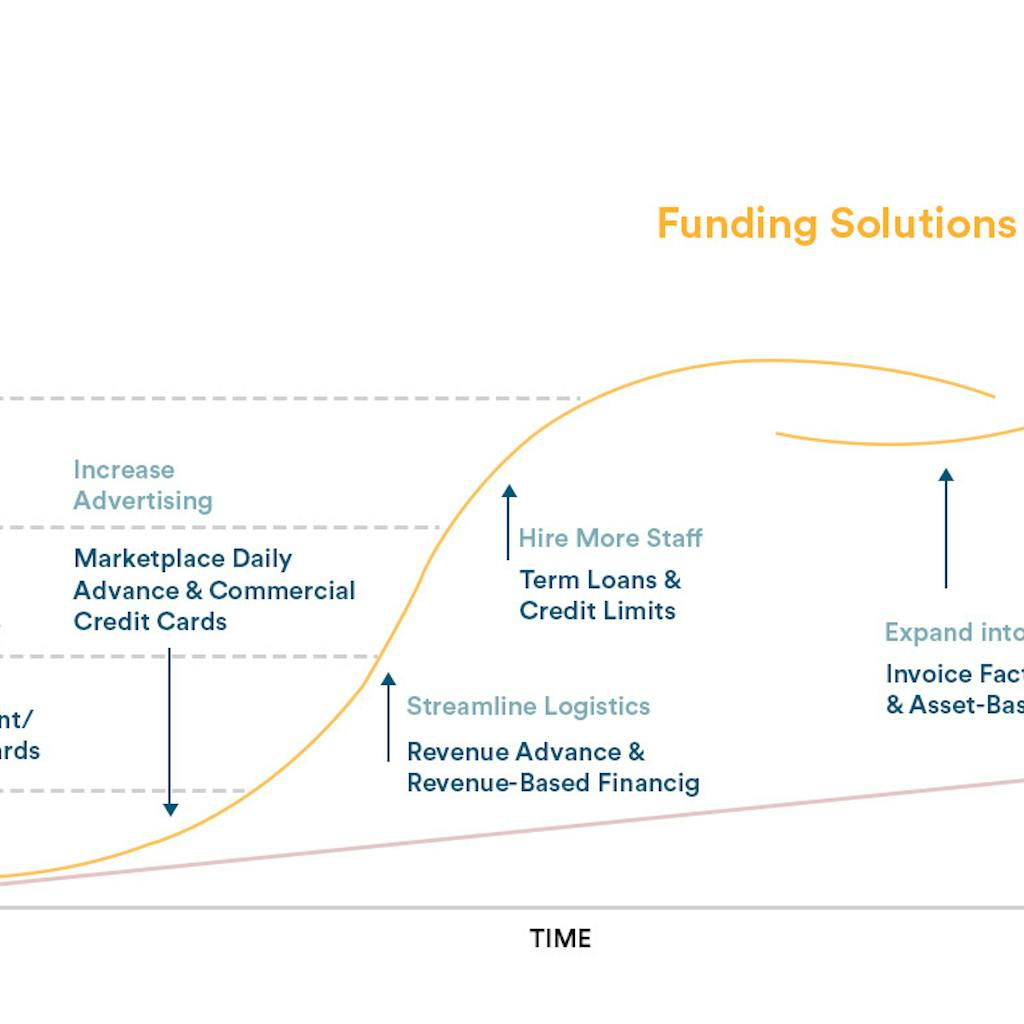

After years in the e-commerce funding industry, we know when certain types of funding are best employed in business growth, as well as hi-ROI uses for that funding.

Personal Credit Cards or Investment

At the beginning of your e-commerce business, it’s most common that you’ll use credit cards or “personal investment” (savings accounts, friends and family, etc.)

One of the biggest drawbacks to using credit cards or personal investments as your main source of funding is that there is a limit (not to mention monthly repayments with steep APRs and penalties for being late). Many early-stage entrepreneurs have maxed out credit cards or cleaned out their savings accounts with the goal of launching a profitable business.

Marketplace Daily Advance or Commercial Credit Cards

As your business gets more established, you’ll have the option for commercial credit cards or even something like a Daily Advance, giving you your marketplace sales on a daily basis instead of following the marketplace’s standard payout schedule (generally every two weeks).

Revenue Advance & Revenue-Based Financing

This type of funding allows you to repay a fixed monthly amount or a percentage of your sales until the loan is paid in its entirety. We see this used frequently with seasonal sellers.

Term Loans & Credit Limits

These funding options are extremely flexible, which is why they’re so popular with high-growth businesses. You can be approved for a certain amount, but only draw what you need when you need it. Interest is only applied to funds drawn and repayment frees up more money resulting in a consistent cash flow.

It’s highly recommended to find a funding partner with no restrictions on how you use your money. Hear from SellersFunding’s CEO, Ricardo Pero, on the benefits of Working Capital and how we’ve helped thousands of businesses scale profitably.

Invoice Factoring, PO Financing & Asset-Based Lending

These forms of funding are most commonly used at the maturity stage of your business.

This type of e-commerce funding allows you to sell your goods to Amazon (or the respective marketplace) as you normally would. Then, you submit your invoices to your funding provider (like SellersFunding) for disbursement.

Working with a partner like SellersFunding also allows you to handle invoices from all over the world in a variety of currencies with one account.

A Funding Partner to Trust

Regardless of the type of online business funding you are sourcing, we highly recommend finding one company that can grow with you. This ensures that you have a true funding partner, and you’re not bouncing around various companies to get what you need. We often see a higher number of providers result in larger expenditures overall.

When you’re looking for this funding partner, we recommend working down this checklist:

- Great reviews and reputation

- Specializes in Amazon & e-commerce

- Seamlessly connects to the Amazon platform to gain approval for funding

- Matches funding solutions with your business needs

- Can grow with you across Amazon Marketplaces

- Offers flexible terms that work for your business (I/O or GP)

- Never tries to sell you on more than you need

SellersFunding has zero restrictions on how you use your money! Whether you’re looking to purchase inventory, expand your warehouse, boost your advertising, or a myriad of other options, get the funding you need to keep the cash flowing and your business growing.

About SellersFunding

SellersFunding is a global financial technology company on a mission to empower growth for e-commerce sellers. The SellersFunding digital platform delivers a suite of financial solutions that streamlines global commerce for thousands of DTC brands, B2B merchants, and marketplace sellers. Our solutions include flexible funding for all stages of the business lifecycle, cross-border cash management, payment tools, and business analytics and insights.